In regions with extreme climates, weather-related damage restoration claims are common from events like storms, hurricanes, floods, or wildfires. Effective insurance coverage should include comprehensive support for diverse repairs, from structural to personal belongings replacement, including auto glass and specialized services. Homeowners and businesses must understand their policy's scope, deductibles, limits, and specific perils covered. Detailed documentation, thorough descriptions, visual evidence, and organized communication are vital when filing claims to expedite the restoration process.

In today’s unpredictable climate, weather-related damage restoration has become an increasingly common concern. From severe storms to natural disasters, these events can leave homes and businesses in disarray. Understanding insurance coverage for such claims is paramount to ensure a smooth recovery process. This article guides you through the intricacies of navigating insurance options for restoration, providing valuable tips on submitting and managing claims effectively. By delving into these aspects, you’ll be better equipped to handle weather-related damage restoration challenges.

- Understanding Weather-Related Damage Restoration Claims

- Navigating Insurance Coverage Options for Restoration

- Tips for Effective Submitting and Managing Claims

Understanding Weather-Related Damage Restoration Claims

Weather-related damage restoration claims are a common occurrence, particularly in regions prone to extreme weather conditions. These can range from severe storms and hurricanes to floods and wildfires, all of which can leave significant destruction in their wake. When properties suffer weather-related damage, homeowners and businesses often turn to insurance providers for assistance in repairing and restoring their spaces.

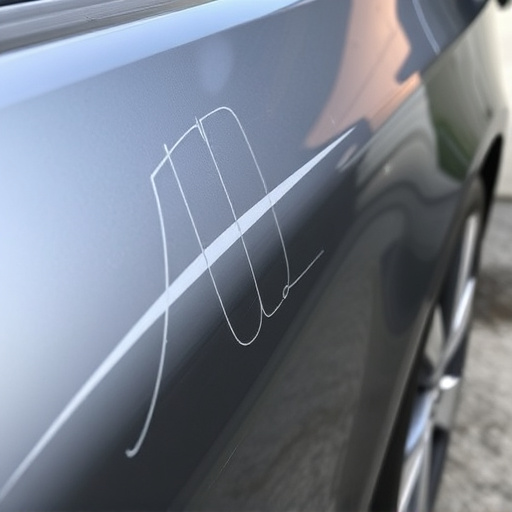

Understanding the scope of these claims is crucial. Weather-related damage restoration involves various aspects, from fixing structural issues caused by storms to replacing damaged belongings due to floods. For instance, auto glass replacement is a common requirement after severe weather events, while Mercedes Benz repair services might be needed for vehicles affected by water damage or other weather-related incidents. Effective insurance coverage should cater to these diverse needs, ensuring that policyholders can rely on their insurers during challenging times.

Navigating Insurance Coverage Options for Restoration

Navigating insurance coverage options for weather-related damage restoration is a crucial step in ensuring prompt and thorough repairs after severe weather events. Homeowners and businesses should first understand their policy’s scope, including deductibles and specific coverage limits for perils like storms, floods, or wildfires. Many standard policies cover the cost of repairing or replacing damaged structures, but not always personal belongings within those structures.

It’s essential to review your policy documents carefully or consult with an insurance agent to identify potential gaps in coverage. For instance, while auto body services and fleet repair services are typically covered under comprehensive or collision insurance, the specifics vary widely between policies. Vehicle body repair, especially for weather-induced cosmetic damages, might fall outside standard coverage and require additional endorsements. Therefore, proactive assessment and understanding of your policy terms can help streamline the restoration process after weather-related disasters.

Tips for Effective Submitting and Managing Claims

When submitting a claim for weather-related damage restoration, clarity and detail are key. Make sure to document all affected areas thoroughly, including photos or videos that showcase both the damage and the restoration process itself. This visual evidence can significantly aid in expediting the claims process and ensuring a more accurate assessment of costs. Additionally, be certain to include comprehensive descriptions of each repair needed, whether it’s for your home, business, or specialized items like car bodywork (in cases of automotive collision repair).

Effective management involves staying organized and responsive. Keep detailed records of all communication with your insurance provider, including dates, names, and the nature of discussions. Promptly provide any requested information or documentation to streamline the claims process. Remember, a well-managed claim can lead to faster settlements and better outcomes, ensuring that restoration efforts for your property (or even a cherished Mercedes Benz repair) can commence without delay.

When dealing with weather-related damage restoration claims, understanding your insurance coverage is key. By navigating the available options and implementing effective claim management strategies, you can ensure a smoother process and faster recovery from unforeseen weather events. Remember, prompt action and thorough documentation are essential to receiving the compensation you deserve for your restored property.